9 Simple Techniques For Short Term Loan

Wiki Article

The smart Trick of Short Term Loan That Nobody is Talking About

Table of ContentsThings about Short Term LoanShort Term Loan for BeginnersThe Single Strategy To Use For Short Term LoanFacts About Short Term Loan RevealedFascination About Short Term LoanAll about Short Term Loan

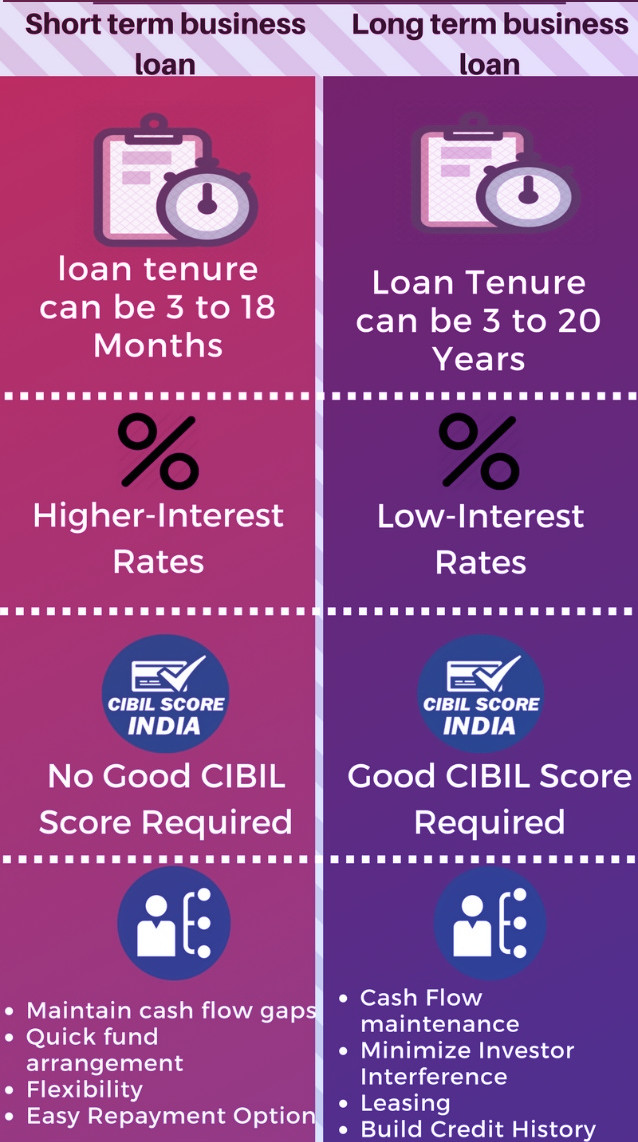

In circumstances like these, lots of people look to short term loans or brief term financing as a means to pay for unanticipated or difficult personal expenses. Temporary funding is a lending option that uses the recipient borrowed funds for momentary costs, comparable to how a short-term lending works!.?.!? Short-term fundings offer you obtained funding that you repay, plus passion, normally within a year or less.A massive benefit of short-term funding is that they can make a huge distinction for people who need immediate access to cash they don't have. Short-term lending lenders do not place a big focus on your credit rating for approval. More crucial is proof of work and also a stable earnings, details concerning your checking account, and also showing that you do not have any superior loans.

A number of types of short-term car loans offer impressive flexibility, which is helpful if money is limited right now yet you prepare for things improving financially soon. Prior to signing for your brief term finance, you and the lender will make a schedule for payments and also concur to the rates of interest up front.

The Buzz on Short Term Loan

The benefit of short-term financing is that you obtain a relatively tiny amount of money immediately, and you pay it back rapidly (Short term loan). The complete interest paid off will normally be a lot less than on a larger, long-lasting finance that has even more time for rate of interest to develop. No financial option is perfect for every customer.

This is why it is essential to weigh your alternatives in order to establish yourself up for success. Have a look at the three top downsides of getting a short term lending. The greatest disadvantage to a temporary finance is the rate of interest, which is higheroften a lot higherthan rates of interest for longer-term car loans.

The smart Trick of Short Term Loan That Nobody is Discussing

In addition to paying back the temporary funding balance, the rate of interest settlements can cause greater repayments on a monthly basis (Short term loan). Nonetheless, maintain in mind that with a temporary lending, you'll be paying back the lending institution within a short period of timewhich methods you'll be paying the high passion for a much shorter time than with a long-term loan.Lasting lendings may have reduced rate of interest, however you'll be paying them over a number of years. Depending on your terms, a temporary loan may in fact be less expensive in the lengthy run. While paying off a short-term financing promptly according to your concurred upon schedule can be a substantial increase to your credit report, stopping working to do so can trigger it to drop.

This can be damaging if you just have a little or excellent credit scores history, and ruining to your future possibility to obtain if you already have poor credit scores. Prior to securing a brief term loan, be truthful with yourself about look at these guys your capability as well as self-control when it involves paying back the funding in a timely manner.

Fascination About Short Term Loan

Considering the leading benefits and also disadvantages of brief term loans will certainly assist you choose if this economic tool is ideal for your situation. The debtor returns the quantity of the car loan to the lending institution over the training course of months instead than years., you can conveniently use for a car loan either online or with a financial institution or credit rating union.The requirements for making an application for a finance are: The consumer ought to be 18 years or over Legitimate email address and contact number Although these are some of the requirements that you might require to fulfill prior to using for a finance, you don't require to have collateral while looking for a lending.

The Single Strategy To Use For Short Term Loan

There are lots of advantages associated with short-term financings. Let's discuss them to help you comprehend exactly how valuable these financings can be.

As you are using for a temporary loan, you should be confident sufficient to settle it in the required timeframe. Users find out here now of short-term finances usually acquire lines of credit scores.

Not known Factual Statements About Short Term Loan

Lots of lending institutions run sites that you can check out directly to apply for a financing swiftly. Given that you have to repay the look at this website financing within a brief duration, the stress and anxiety connected with settling it will not last for long!You can simply make an application for a lending and also settle it as soon as you earn adequate profit.

Report this wiki page